iowa inheritance tax form

Adopted and Filed Rules. This document is found on the website of the government of Iowa.

Iowa Inheritance Laws What You Should Know

An extension of time to file the return and to make payment may be requested using the current Department-approved Iowa Inheritance Tax Application for Extension of Time to File.

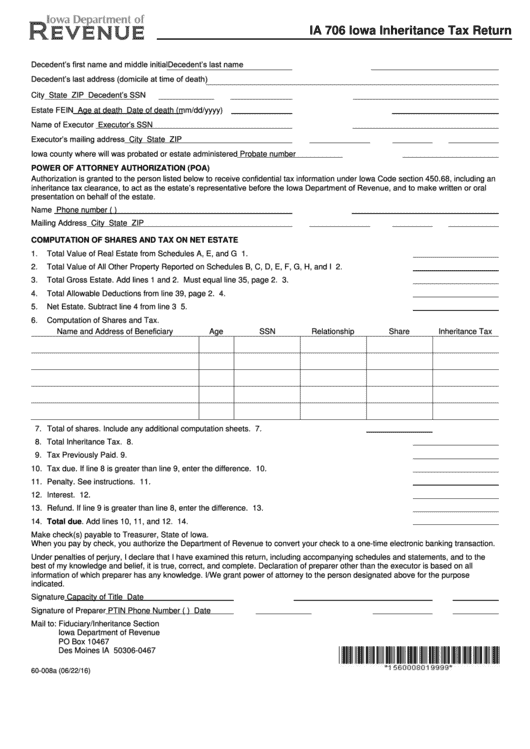

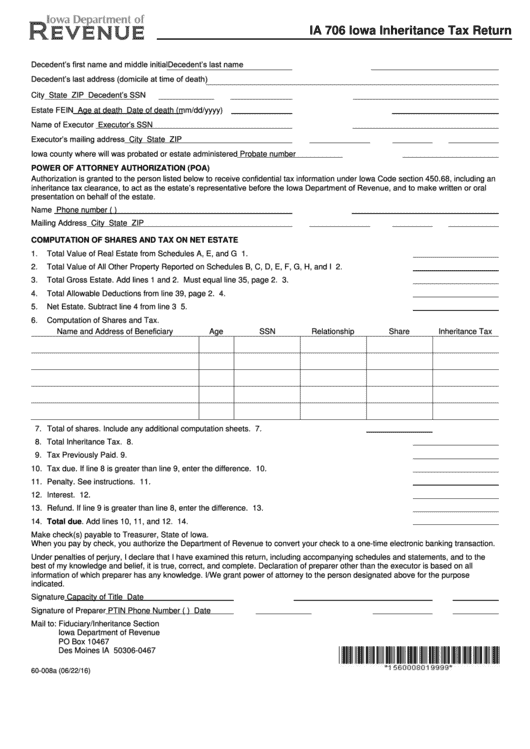

. The Iowa Inheritance Tax is filed using form IA706 which can be downloaded from the Iowa State Department of Revenue website at wwwiowagovtaxformsinherithtml. Download Or Email IA 706 More Fillable Forms Register and Subscribe Now. A summary of the different categories is as follows.

If the net value of the decedents estate is less than 25000 then no tax is applied. Concerned parties names places of residence and numbers etc. Its important to file the Iowa Inheritance Tax form Form IA 706 by the last day of the 9th month after the person passed away.

It must also be paid within that time otherwise the State of Iowa is allowed to impose interest on the amount due. Iowa does have an inheritance tax which beneficiaries are responsible for paying on their inheritance. Iowa Inheritance Tax Schedule J 60-084.

Up to 25 cash back Exemptions From Iowa Inheritance Tax. Enter the decedents name date of death age at the time their address at the time of death and federal identification and Social Security numbers. Report Fraud.

Iowa Inheritance and Gift Tax. Law. If the deceased persons net estate discussed below is worth 25000 or less no inheritance tax is due.

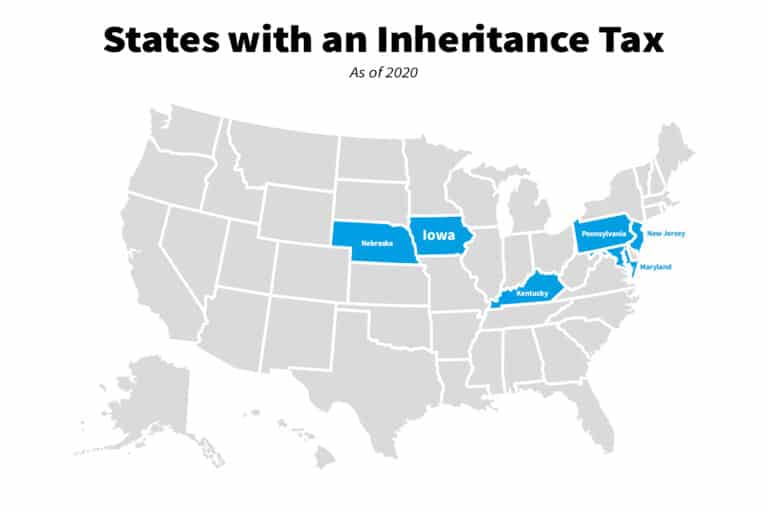

The document has moved here. Iowa inheritance tax is a tax paid to the State of Iowa and is based upon a persons beneficiary or heir right to receive money or property that was owned by another person decedent at the time of death and is passing from the decedent to the beneficiary or heir. This is something you need to take into consideration before preparing Iowa Last Will and Testament to avoid any legal fees and penalties from the IRS in the future.

Learn About Property Tax. The inheritance tax return must be filed and any tax due must be paid on or before the last day of the ninth month after the death of the decedent or life tenant. Start completing the fillable fields and carefully type in required information.

Report Fraud. 4504 Additionally no inheritance tax return is required if the inheritors are exempt from inheritance tax. Change the blanks with unique fillable fields.

This is for siblings half-siblings and children-in-law. Include the date and place your e-signature. GENERAL INSTRUCTIONS FOR IOWA INHERITANCE TAX RETURN IA 706 The return must be filed and any tax due paid on all property coming into present possession and enjoyment within nine months after death for estates of decedents dying after.

Open it with cloud-based editor and start editing. File a W-2 or 1099. Quick steps to complete and eSign Iowa Inheritance Tax Form online.

Schedule B beneficiaries include siblings half-siblings sons-in-law and daughters-in-law. General Instructions for Iowa Inheritance Tax Return IA 706 Return Required. Your expectations presented in the paperwork can be contested.

To pay inheritance and estate tax in the state of Iowa file a form IA 706. Use Get Form or simply click on the template preview to open it in the editor. Stay informed subscribe to receive updates.

Fill out the empty areas. See the Iowa Inheritance Tax Rate Schedule Form 60-061 090611. Learn About Sales.

If an extension is granted the. The rate ranges from 5 to 10 based on the size of. What is Iowa inheritance tax.

Iowa InheritanceEstate Tax Return IA 706 Step 1. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. There are a number of categories of inheritor for the inheritance tax but only two are relevant for individuals.

Adopted and Filed Rules. The Iowa inheritance tax rate varies depending on their relationship of the inheritors to the deceased person. An inheritance tax return must be filed by the fiduciary of any estate when the gross share subjected to tax without reduction for liabilities of any beneficiary heir transferee or surviving joint tenant exceeds the allowable exemption from such share or if a federal return has been filed.

Exactly how much recipients are obliged to pay out in estate or inheritance tax is defined by the state you live in. Tax Credits. All the beneficiaries of the estate and their respective shares are included on one form IA706.

Get the Iowa Ia 706 Inheritance Tax Return Only - State Legal Forms you need. Adopted and Filed Rules. Iowa InheritanceEstate Tax Return IA 706.

Many close family members do not have to pay the tax. Iowa InheritanceEstate Tax - Consent and Waiver of Lien 60-014. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

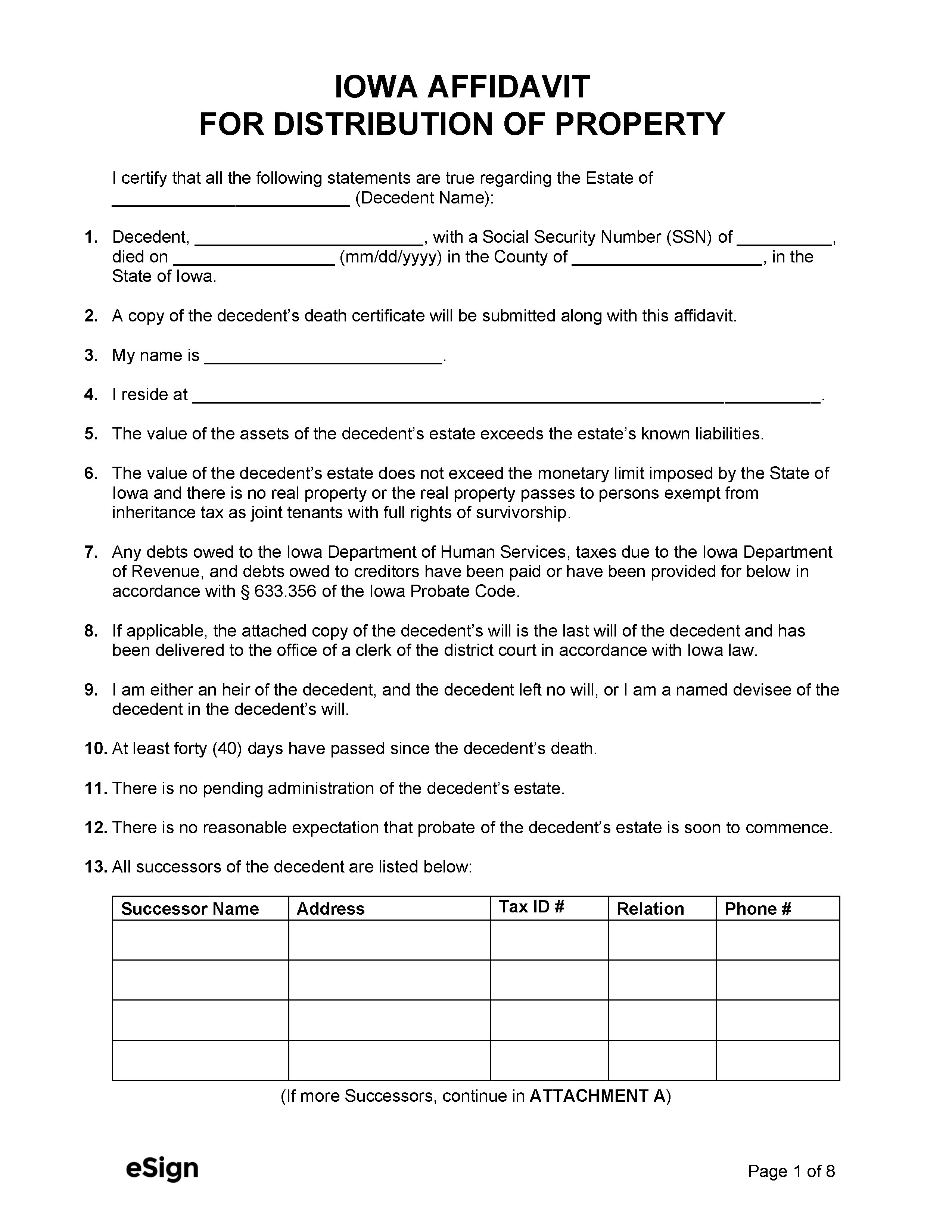

Iowa Small Estate Affidavit Form Fill Online Printable Fillable Blank Pdffiller

The Inheritance Tax In Iowa How To File

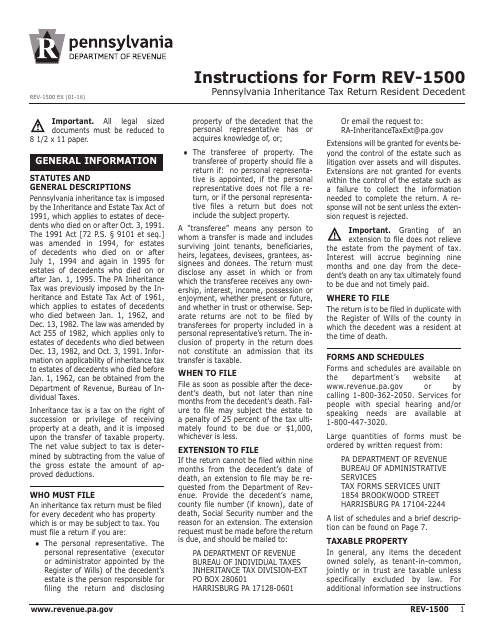

Inheritance Tax Return Nonresident Decedent Rev 1737 A Pdf Fpdf Docx Pennsylvania

Download Instructions For Form Rev 1500 Pennsylvania Inheritance Tax Return Resident Decedent Pdf Templateroller

The Inheritance Tax In Iowa How To File

The Inheritance Tax In Iowa How To File

Free Iowa Last Will And Testament Templates Pdf Docx Formswift

The Inheritance Tax In Iowa How To File

Community Banking News Blog Community Bankers Of Iowa Cbi

The Inheritance Tax In Iowa How To File

Calculating Inheritance Tax Laws Com

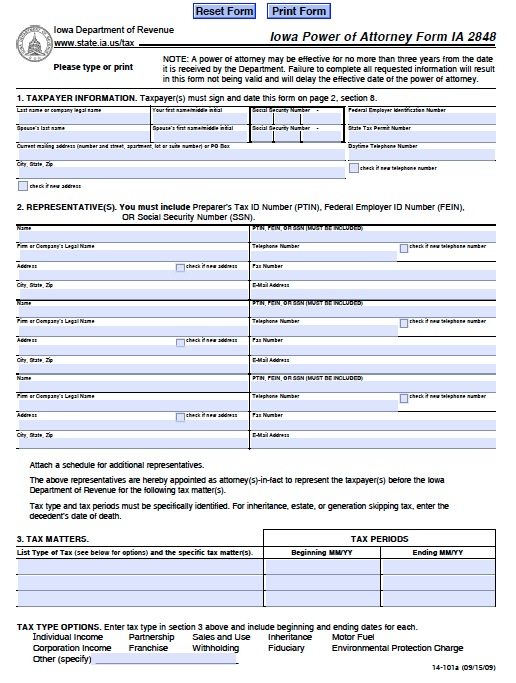

Free Tax Power Of Attorney Iowa Form Ia 2848 Adobe Pdf

The Inheritance Tax In Iowa How To File

Arizona Inheritance Tax Waiver Form Fill And Sign Printable Template Online Us Legal Forms

Free Iowa Small Estate Affidavit Form Pdf Word

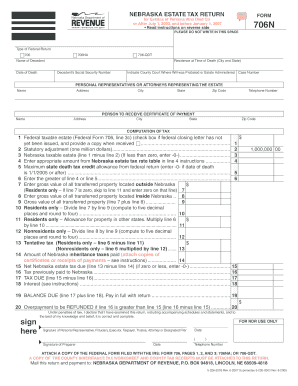

Fillable Online Revenue Ne Nebraska Estate Tax Return Form 706n Fax Email Print Pdffiller

The Inheritance Tax In Iowa How To File

How Much Tax Do You Pay On Inheritance Legacy Design Strategies An Estate And Business Planning Law Firm