what is suta tax rate

The 2022 wage base is 7700. Lets say your business is in New York where the lowest SUTA tax rate for 2021 was 2025 and the highest was 9825 and youre assigned a rate of 4025.

Futa Tax Overview How It Works How To Calculate

The State Unemployment Tax Act commonly referred to as SUTA tax is a state unemployment insurance program requiring employers to pay towards a fund.

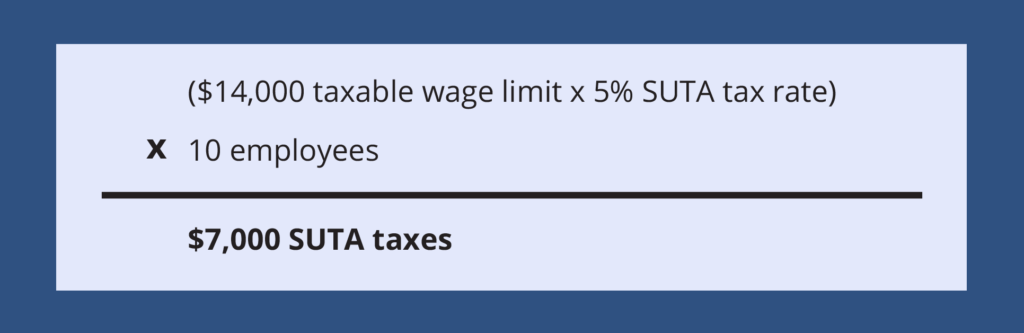

. If liability is 500 or less you can go. 0010 10 or 700 per. Please note that tax rates are applicable to the first 14000 each employee earns.

General employers are liable if they have had a quarterly payroll of 1500. Taxable base tax rate. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34.

Heres how to calculate and pay unemployment tax in your state. To see the tax rate schedule ratio rate table and the FUTA creditable factors for ratio-rated. While the Texas unemployment tax rate range remains the same for 2021 from a minimum of 031 percent to a maximum of 631 percent it is not all good news for employers.

Form 940 is due each year on January 31. 24 new employer rate Special payroll tax offset. The states SUTA wage base is 7000 per.

Employers may make a voluntary. A Contribution Rate Notice Form UC-657 is mailed to employers at the end of each calendar year and shows the contribution rate effective for the coming calendar year. The minimum and maximum tax rates for wages paid in 2022 are as follows based on annual wages up to 7000 per employee.

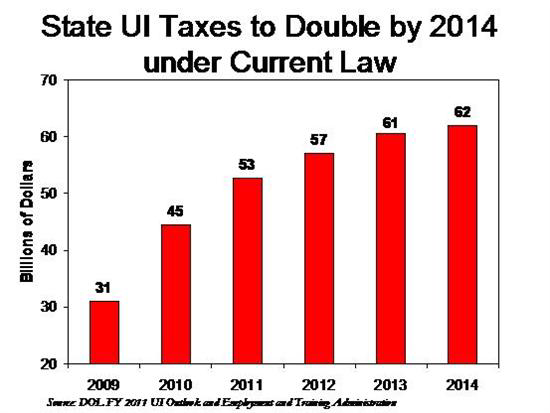

You can get tax rate information and a detailed listing of the individuals making up the three-year total of benefit chargebacks used in your Benefit Ratio online or by phone fax. Louisiana Unemployment Insurance Tax Rates. State Unemployment Tax Act SUTA avoidance or dumping is a form of tax avoidance or UI tax rate manipulation through which employers dump higher UI taxes by attempting to obtain a.

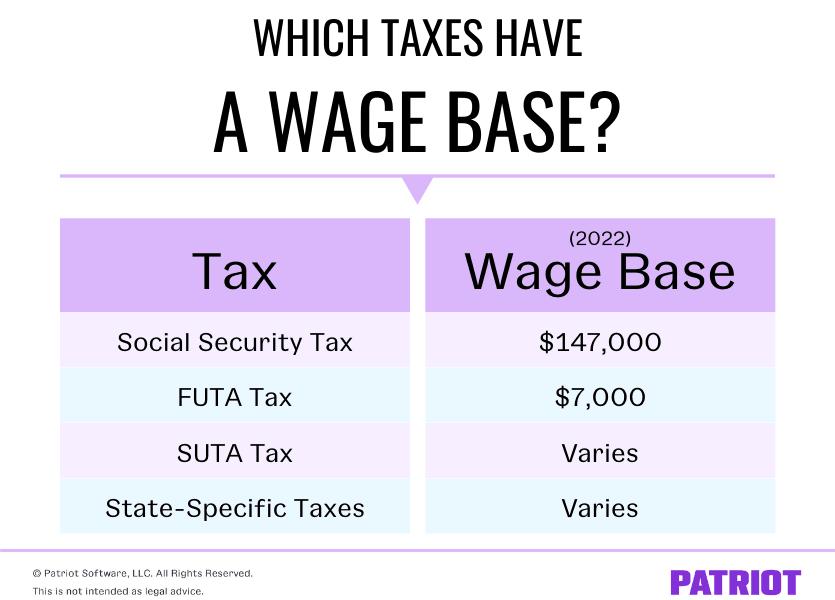

The first component of the tax rate is the experience-based tax which is based on the amount of unemployment benefits paid to. You should be aware of current rates and understand how the tax is calculated. State taxes vary including the State Unemployment Tax Act SUTA contribution rates.

The tax class assignment in the notice should be used for the full calendar year. New Employer Rate If an employers account is not eligible for an experience rate the account will be assigned a standard new employer rate of 27 unless the employer is engaged in the. The reserve ratio is the balance in an employers UI account premiums paid less benefits paid for all years liable divided by their average taxable payroll for the three most recent years.

Although tax rates for each. Employers are liable for unemployment tax in Virginia if they are currently liable for Federal Unemployment Tax. Current Tax Rate Filing Due Dates.

The tax rate shown on the Unemployment Tax Rate Assignment Form becomes final unless protested in writing prior to May 1 of the following year. Employers are required to pay state unemployment insurance taxes. FUTA tax is filed using Form 940 the Employers Annual Federal Unemployment Tax Return.

There are two components of the state unemployment tax.

What S The Cost Of Unemployment Insurance To The Employer

What Is The Futa Tax 2022 Tax Rates And Info Onpay

Are Employers Responsible For Paying Unemployment Taxes

How To Calculate Unemployment Tax Futa Dummies

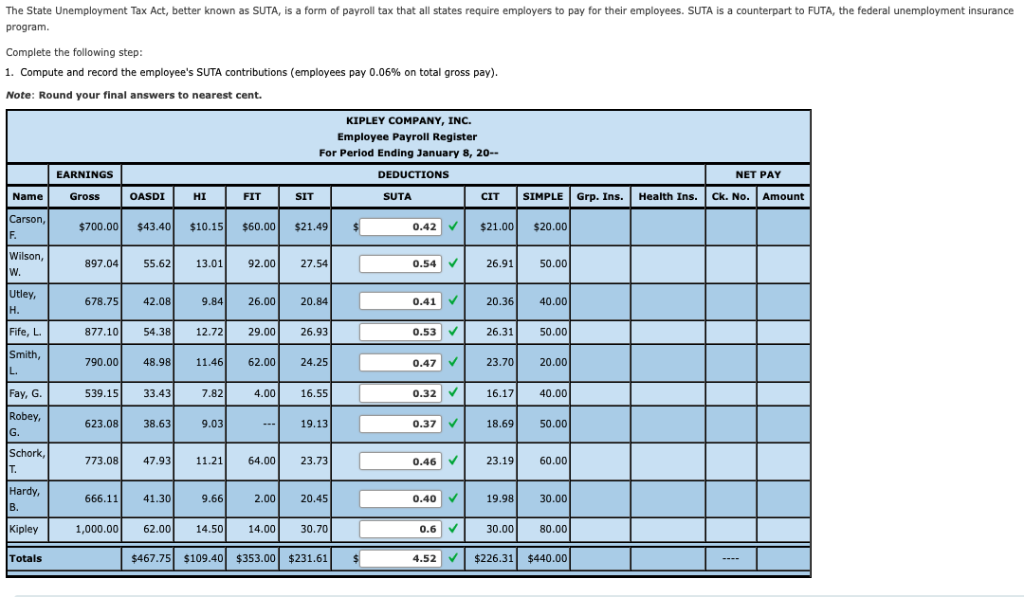

Solved The State Unemployment Tax Act Better Known As Suta Chegg Com

2022 Federal State Payroll Tax Rates For Employers

How To Reduce Your Clients Suta Tax Rate In 2014

Futa Suta Unemployment Tax Rates Procare Support

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

Oed Unemployment Ui Payroll Taxes

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

What Is A Wage Base Taxes With Wage Bases More

Reducing Unemployment Insurance Costs Ui Suta

State Unemployment Tax Act Suta Tax Rates 123paystubs Youtube

Glencoe Mcgraw Hill Payroll Taxes Deposits And Reports Ppt Download

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate